/

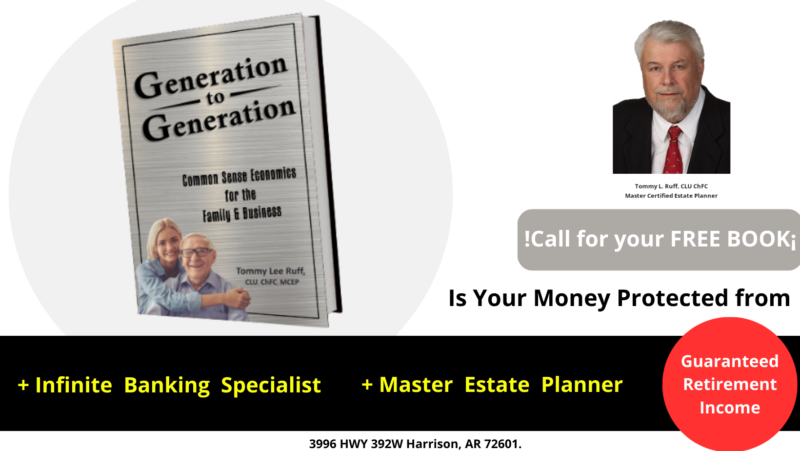

Tommy L. Ruff, CLU ChFC

Master Certified Estate Planner

40 Years of Experience

Creating Wealth and Keeping It in the Family is My Mission.

AR Ins. Lic. # 833538

MO Ins. Lic. # 0168819

TX Ins. Lic. # 1587724

12k

CLIENTS

40+

YEARS

Generation to Generation

Teaching Families and Business Owners Common Sense Financial Concepts to Overcome the Economic Challenges of Tomorrow.

✓ Easy Learn

✓ Beautifully Life´s

Call 844-906-0606 to schedule a time for us to have a conversation.

“I have learned over the last four decades the secrets of making sure people never lose money in the markets while eliminating those small management fees that rob a large portion of a person’s retirement account.

Wouldn’t you agree with me that the Constitution of the United States and the Bible are the two most important documents that have ever been written? I am convinced that a financial or estate plan that is not written and then reviewed annually is a waste of time and money.

This is why I do not believe in the financial planning process that is being presented to the American public today. Because most are based on assumptions and projections that rarely ever come to fruition.”

Successfully resolved cases and proven experience

¿READY TO RETIRE?

Privatize Family Banking

Whether you are trying to create wealth, protect your family, or preserve your assets, my personalized service focuses on your needs, wants, and long-term goals.

Master Estate Planner

Retirement planning can be tricky and at age fifty and beyond – retirement is just around the corner or has arrived.

Retirement Planning

As a financial professional, I am committed to helping people just like you create solutions for their retirement assets.

Work Process

01

KNOWLEDGE

that will lead you to life transforming knowledge on the subject matter of personal finance.

02

EXPERIENCE

Let my years of experience and understanding of current events help you prepare for a better future.

03

FINANCE

When you understand the rules of the money game and you are exposed to what is really going on concerning your coveted estate that you and your family have worked so hard to create, then and only then, will you be fully equipped to make better economic choices.

Our Customers Said

★ ★ ★ ★ ★

4.85 from 1,3K+ Reviews

“Banking”

Tommy

!Thank you for introducing us to privatized family banking¡

★ ★ ★ ★ ★

— Randy & Marlene Aylor.

Springfield, MO.

“Program Retirement”

We would recommend tommy ruff to anyone who has a retirement program and who is concerned with losing money or paying fees.

★ ★ ★ ★ ★

— Dr Joel Chaey

Springfield, MO

“Financial Class”

I cannot believe how much i learned from your ” Common Sense Economics” Financial Class.

★ ★ ★ ★ ★

— Diane Harsfield, CPA

Rogers, AR

EIGHT QUESTIONS

YOU SHOULD BE ABLE TO ANSWER

1

Do you know what rate of return you must earn on your current investments to sustain your current lifestyle?

2

Are your assets protected from Probate and other outside predators?

3

Do you know how to become tax-free instead of the perfect tax payor?

4

At your retirement, should your account value be less than you had anticipated, what hobbies or other lifestyle pleasures will you be required to give up to prevent you from every running out of money during your lifetime?

7

How long will you continue working after your ideal retirement date?

5

Do you know how much you need to be saving right now to fund your retirement years?

8

Have you factored inflation into your retirement calculations? What percentage rate are you using?

6

Is your retirement account insured from market losses?

ARE YOU REALLY TO RETIRE?

We’re here to help. Let’s talk.